Canada belongs to the group of countries that have incorporated special place-of-supply rules into their indirect tax frameworks for the provision of digital services by non-resident providers. The place of supply rules for B2C transactions related to digital services and intangible personal property are determined following the destination-based principle.

Non-resident providers of digital services or intangible personal property should be registered for Canada GST when the stipulated threshold for the particular GST scheme is reached. A non-resident provider of digital services or intangible personal property could register for GST under the simplified or normal GST scheme.

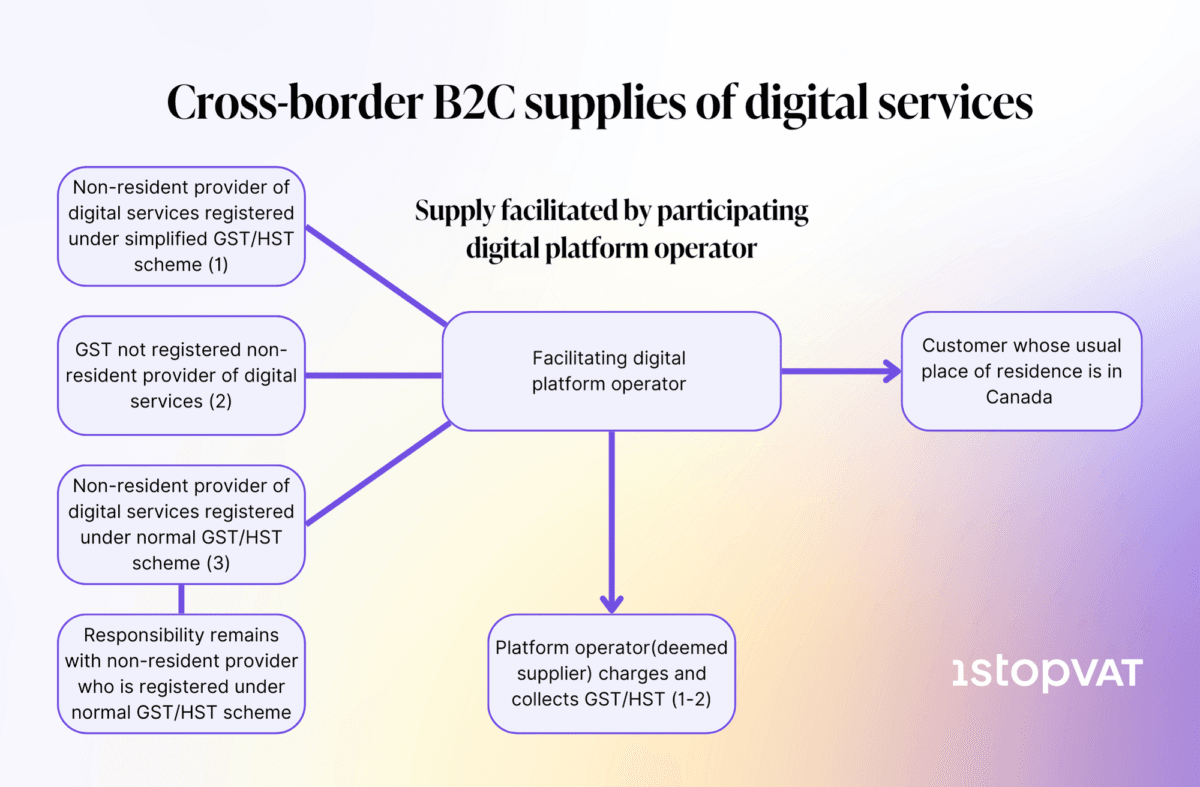

Considering that a significant number of non-resident providers of digital services supply their services through digital platforms, the responsibility for tax charging and collection could differ, depending on who is determined to be a tax-responsible person under Canada’s GST rules.

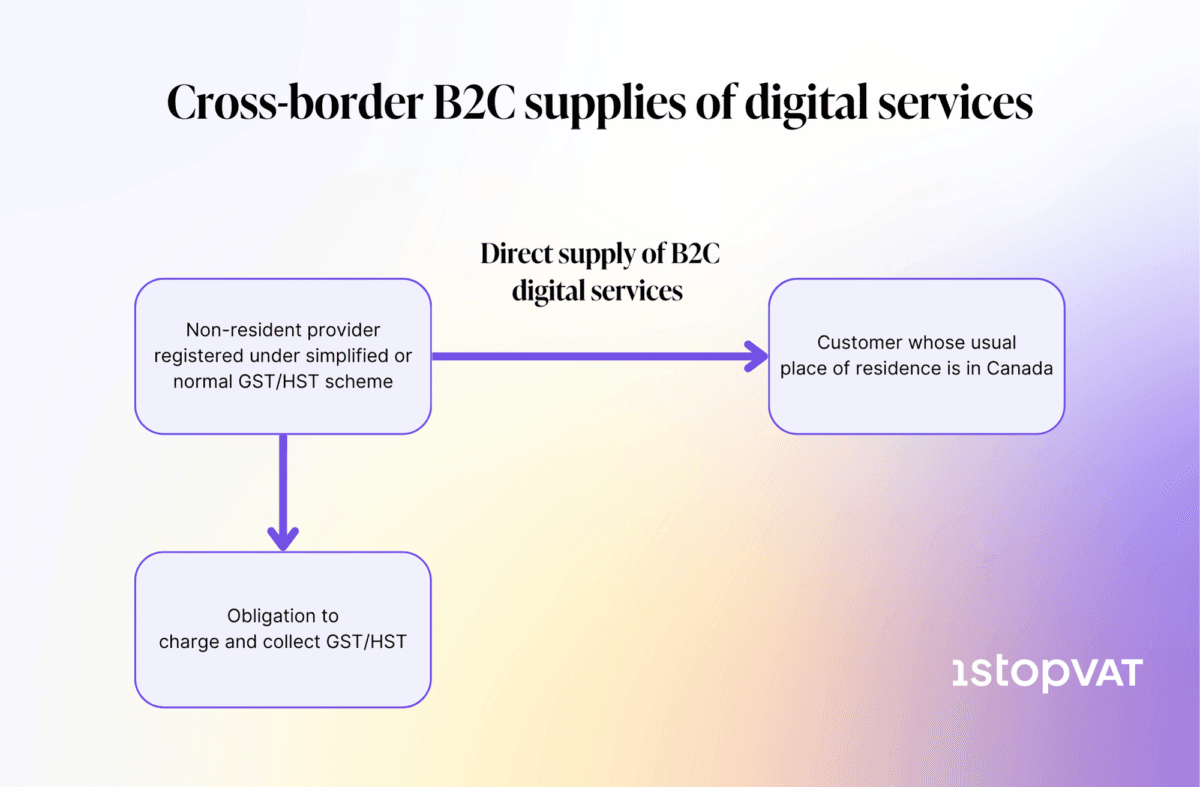

In situations where a GST/HST-registered non-resident provider of digital services makes its supplies directly to customers based in Canada (B2C transactions), the responsibility for GST compliance remains solely with them. On the contrary, when the digital platform operator facilitates the supply, the tax responsibility could be transferred to the registered platform operator.

For better understanding and clarification, please refer to the flowchart shared below. If you are interested in learning more about Canada’s GST rules and regulations, please refer to our Canada tax guides, which provide a detailed review of the GST/HST regime governing federal Canada, participating provinces, and provinces that have their own sales tax rules.

How to stay compliant with Canada GST/HST rules

If you are a non-resident digital service provider or you operate a digital platform that facilitates supplies of digital services or intangible personal property to customers who usually reside in Canada, you should consider the following steps :

- Review of your Canada-based turnover

- Registration for GST/HST under simplified or normal regime

- Proper Invoicing and Reporting

- Development of appropriate tax monitoring tools

If you have any questions, please don’t hesitate to contact us. We are here to help.

Aleksandar Delic

1stopVAT Indirect Tax Manager – E-Commerce