Summary

Summary

Learn about the EU’s new VAT reform for e-commerce vendors, including the introduction of the Import One-Stop-Shop (IOSS) scheme to simplify VAT reporting.

On July 1, 2021, the EU introduced a major VAT reform that has significantly reshaped the tax framework for the e-commerce and digital economy sectors. To reduce the uneven playing field between EU and non-EU online vendors, as well as to reduce VAT revenue losses arising from underdeveloped reporting mechanisms for low-value consignments, it has introduced new simplified VAT reporting schemes under the One-Stop-Shop (OSS) regime.

Framework of Import One-Stop-Shop

One part of this regime is the Import-One-Stop-Shop(IOSS) scheme. The IOSS scheme allows online vendors and e-marketplace operators to sell imported products directly to consumers (B2C supply). The intrinsic value of the consignment per person cannot be above EUR 150. This is the EU-based threshold for low-value imports for consignments coming outside the EU, for B2C distant supply.

IOSS can be used if the following criteria are met:

- Direct supply to EU customers(B2C supply)

- The goods are shipped from outside the EU

- The goods are not subject to excise duty

- Consignment intrinsic value is less than EUR 150

The IOSS simplifies the collection, declaration, and remittance of VAT for vendors that make distant supplies of imported products directly to buyers who are resident in the EU. There are many benefits for buyers, such as no need to pay import VAT at the point of entry of the consignment into the EU; no need to submit additional customs declarations for customs clearance; no risk of additional tax charges; and no administrative hassle.

VAT is paid at the point of sale (virtual POS on the website) and is final, based on the customer’s address or the destination country. There is no import duty on the low-value consignments imported into the EU for B2C sales when the vendor is registered for the IOSS.

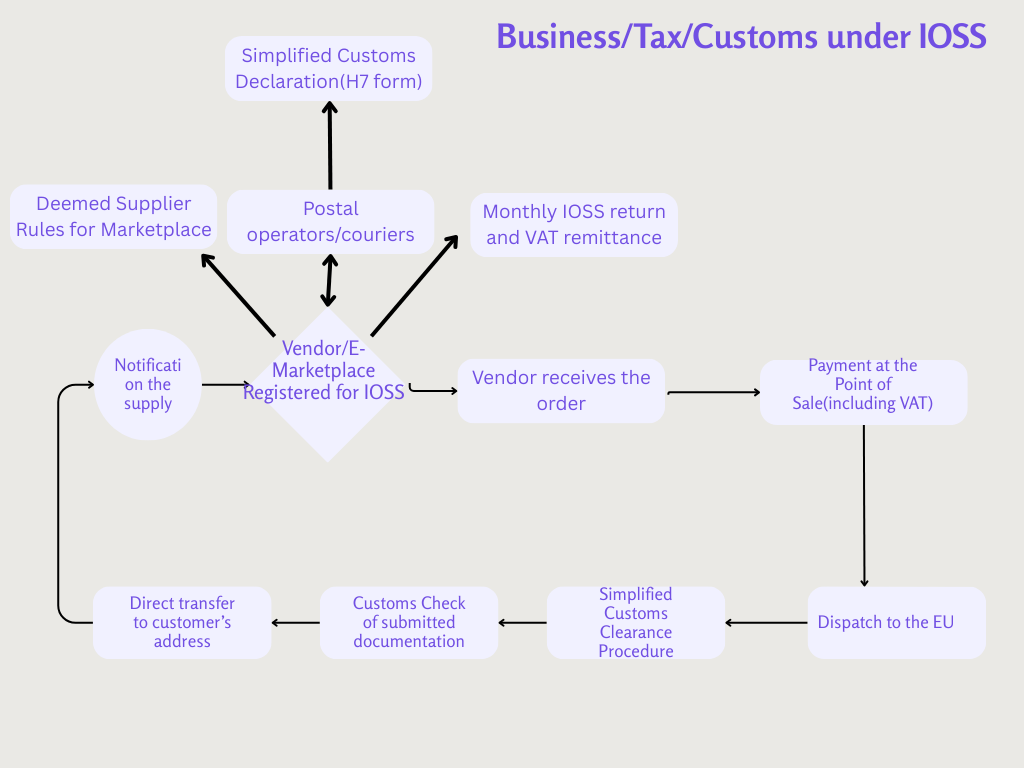

IOSS-registered taxable persons benefit greatly from the simplified customs clearance procedure. Taxable persons who aren’t registered for IOSS cannot benefit from the EU centralised customs clearance procedure. The usual business, tax, and customs processes that form the flow for B2C distant supply of imported LVG, along with the related responsibilities of the vendor and other closely connected parties, are shown in the flowchart below.

Taxable Supply Under IOSS

How to Stay Compliant

If you operate as a cross-border online merchant or an e-commerce marketplace serving customers across the EU, the benefits of the IOSS scheme unquestionably outweigh the cons. However, it should be noted that the benefits of the IOSS registration apply only to B2C imports of low-value goods dispatched from outside the EU.

IOSS registration allows your business to collect VAT on behalf of your customers for all B2C distant sales of low-value goods imported from outside the EU, using a single monthly IOSS return. Simplified registration, simplified tax collection, and remittance. Lower costs for your business operations in the EU, less administrative work, and more time to focus on expanding your business.

If you have any questions concerning the IOSS or OSS scheme,s do reach out to us. We are experts in EU VAT OSS compliance because we have been here from the first days of the 2021 E-commerce reform.

Our tax team would be happy to assist you.

Numbers undoubtly indicate that taxable persons registered under Import One-Stop-Shop scheme, have significantly less EU VAT compliance challenges, less costs, they enjoy a centralised simplified customs clearance procedure.

Author: Aleksandar Delic

Indirect Tax Manager – E-commerce

Frequently Asked Questions

The Import One Stop Shop is a simplified EU VAT scheme introduced on July 1, 2021. It allows online vendors and e-marketplace operators to collect and declare VAT on low-value goods imported into the EU and sold directly to consumers.

IOSS applies to B2C sales where goods are shipped from outside the EU, are not subject to excise duties, and have an intrinsic value not exceeding EUR 150 per consignment.

VAT is charged at the point of sale based on the customer’s location. Once collected, the VAT is declared and remitted through the IOSS return, and no import VAT is due when the goods enter the EU.

Consumers do not need to pay import VAT upon delivery, face fewer customs formalities, avoid unexpected tax charges, and receive parcels faster due to simplified customs clearance.

Vendors benefit from simplified VAT reporting, centralized VAT payments through a single IOSS return, faster customs clearance, and reduced risk of delivery delays or customer complaints related to import taxes.

Register for a FREE consultation

We offer a FREE consultation to better understand your needs. This could result in a simple solution to your taxes issues or lead to a more collaborative working relationship. Let’s find out what’s the best solution for you!

Book a Free consultation