VAT Penalties Cost EU Businesses €159 Million in 2022.

Protect Your Company Today

Don’t let VAT compliance mistakes destroy your business. Even honest errors can result in devastating 20% penalties. Our certified experts help you navigate EU VAT complexities before problems arise.

The Growing VAT Penalty Crisis

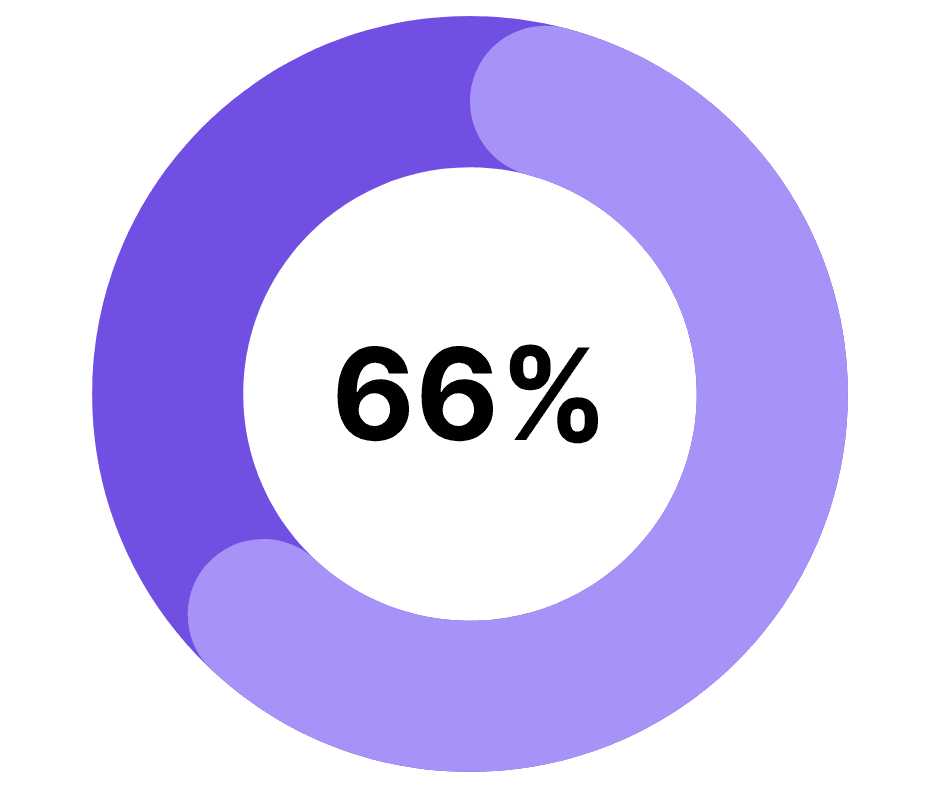

66% Surge in VAT Penalties Threatens Every EU Business

Recent data reveals a shocking reality: VAT penalties increased from 39,759 cases to 66,000 cases in just one year. This dramatic escalation means your business faces unprecedented compliance risks that traditional accounting services simply cannot address.

The €200,000 Mistake That Changed Everything

The Grupa Warzywna case sent shockwaves through the EU business community when the Court of Justice of the European Union (CJEU) upheld a €200,000 penalty for documentation errors. This landmark ruling proves that even businesses operating in good faith can face crippling financial consequences for seemingly minor compliance mistakes.

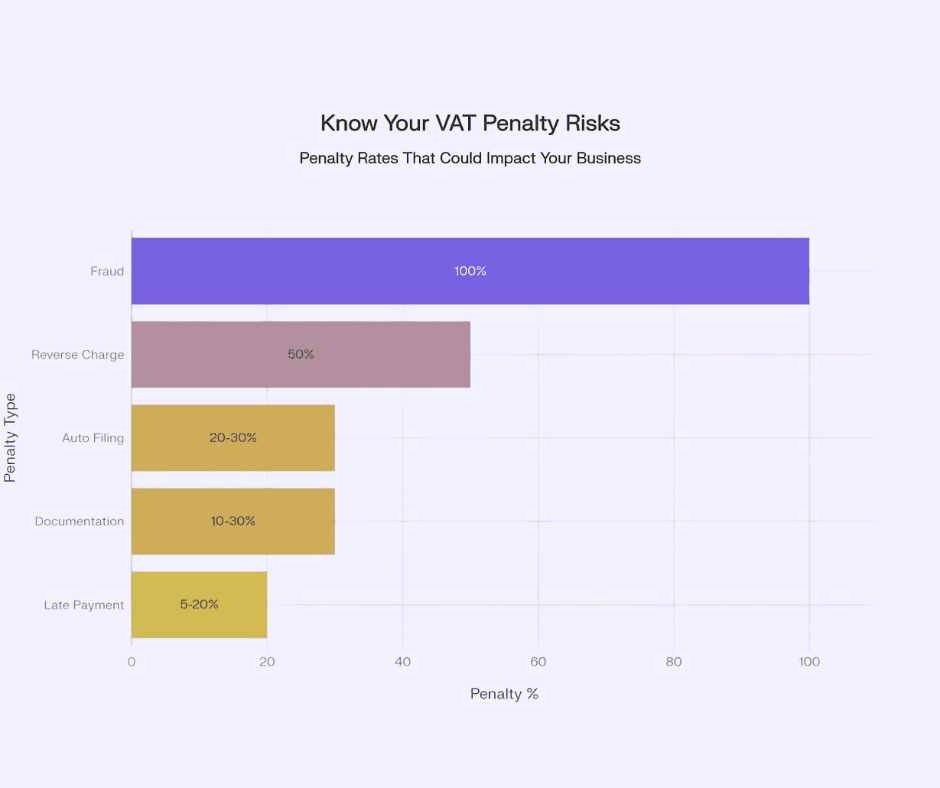

Are you making these same critical errors?

- Incomplete VAT registration documentation

- Missing cross-border transaction records

- Incorrect reverse charge applications

- Inadequate invoice formatting

- Delayed VAT return submissions

Why Traditional VAT Services Leave You Vulnerable

Most VAT providers only react after penalties occur, leaving you exposed to the very risks you’re paying to avoid. While they process your returns, they don’t protect your business from the compliance traps that trigger investigations.

The 1stopVAT Difference: Proactive Protection

We don’t just handle your VAT — we prevent VAT problems before they become penalties. Our approach combines cutting-edge technology with deep regulatory expertise to create an impenetrable compliance shield around your business.

Before the next threshold or audit hits – get VAT under control

Whether you’re launching in the EU, onboarding new users globally, or preparing for audits, we’ll help you stay compliant and focused on care delivery.

Request a free consultationWhy sellers choose us?

Penalty Prevention Technology

Our proprietary systems monitor 47 compliance checkpoints alerting you to potential issues before they become expensive problems.

CJEU Case Law Expertise

Our team includes certified specialists who understand how recent court decisions like Grupa Warzywna affect your daily operations.

Complete EU Coverage

From Ireland to Romania, we handle VAT compliance across all 27 EU member states with local expertise in each jurisdiction.

Prompt Emergency Support

When urgent VAT issues arise, our experts are available around the clock to prevent costly mistakes.

Client feedback

Register for a FREE consultation

We offer a FREE consultation to better understand your needs. This could result in a simple solution to your taxes issues or lead to a more collaborative working relationship. Let’s find out what’s the best solution for you!

Book a Free consultation

What are the consequences of not being compliant?

How to ensure compliance?