One Stop Shop

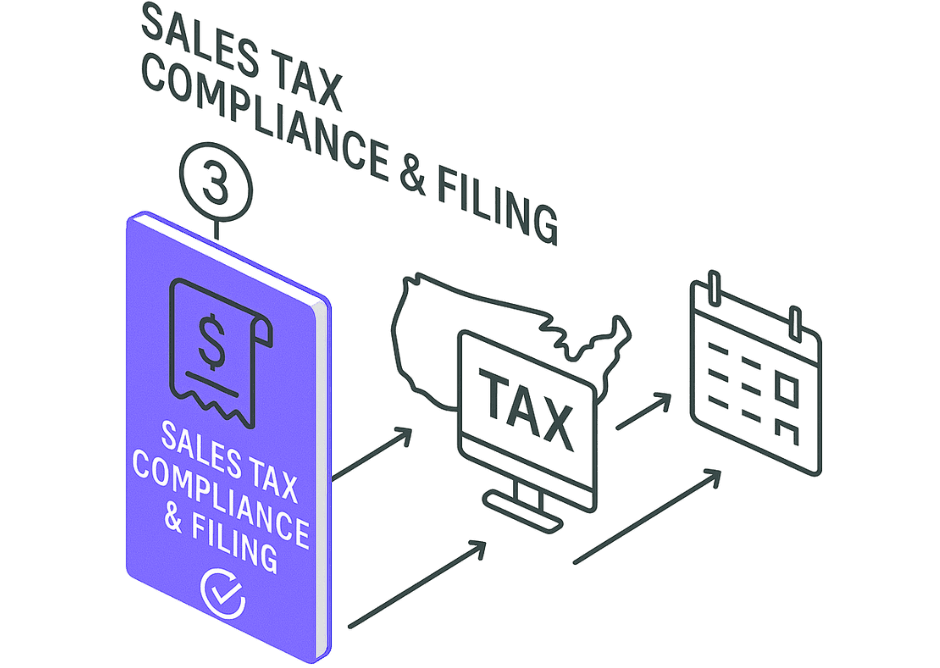

Additional Tax Compliance Services for Global Businesses

Beyond VAT, 1stopVAT provides a comprehensive suite of indirect tax compliance services tailored for specific countries and business models. Whether you’re managing sales tax in the U.S., GST in India, or IOSS requirements in the EU, we help ensure full compliance while supporting your global expansion. Our additional services are designed for digital-first companies, SaaS providers, eCommerce sellers, and cross-border platforms. Explore how we can simplify complex tax obligations across multiple regions.

Services

Check what we can do for you

IOSS & OSS Compliance

Simplify EU VAT reporting with Import One-Stop Shop (IOSS) and One-Stop Shop (OSS) registration and filing. Ideal for non-EU sellers and platforms delivering goods across Europe.

EORI Registration Service (EU & UK)

Fast-track your cross-border operations with compliant EORI (Economic Operator Registration and Identification) registration for the EU and UK. Essential for customs declarations and import/export VAT handling.

Sales Tax Compliance & Filing (U.S.)

Navigate the complexity of U.S. sales tax regulations. We help you identify economic nexus, handle multi-state registrations, and automate your filing obligations.

Sales Tax Consulting Services

Get expert support with your U.S. sales tax strategy, including nexus analysis, audit readiness, and compliance planning. Ideal for SaaS companies, digital sellers, and marketplaces.

GST Compliance (India, Singapore, Australia & more)

Register and file Goods and Services Tax (GST) returns for digital services in India, Singapore, Australia, and other APAC markets. Stay compliant with local tax regulations and avoid penalties.

Need help choosing the right service?

Book a free consultation with one of our indirect tax experts – and we’ll help you determine exactly which services your business needs based on your industry, platform, and countries of operation.

Book a Free consultationFAQ

Have questions?

What’s the difference between VAT and Sales Tax?

VAT is applied at every stage of the supply chain and is common in the EU and other regions, while Sales Tax is collected only at the final point of sale and is used in the U.S.

Do I need to register for Sales Tax if I sell SaaS in the U.S.?

Yes, if you meet economic nexus thresholds in specific states, you may be required to register and file even as a non-U.S. business.

What is an EORI number and who needs it?

An EORI number is required for businesses importing or exporting goods into or out of the EU or UK. It’s essential for customs clearance and VAT declarations.

Is IOSS required for non-EU sellers?

Yes, if you sell goods under €150 to EU customers and want to collect and remit VAT at checkout, IOSS registration is strongly recommended.

Your one-stop global compliance solution

Worldwide coverage

We proudly provide indirect tax compliance services, including VAT, Sales Tax, and digital taxes, in 100+ jurisdictions worldwide. With a highly efficient tracking system for filing deadlines, our expert team ensures seamless compliance. We’re continually expanding our global reach in indirect tax services.

Compliance partners

We’ve built a strong network of partners and tax consultants worldwide to manage local requirements transparently and efficiently. In many regions, we collaborate with local tax agents to ensure seamless indirect tax compliance for cross-border suppliers.

Reliable monitoring system

Our Reporting team brings extensive expertise in indirect tax return services, ensuring your business stays compliant. We provide timely notifications about filing returns and deadlines, helping you avoid regulatory breaches.

Certified experts

Our team is combined of more than 40 experts, who can provide wide range of services and are certified members of IVA, AITC and VAT Forum. Currently we have more than 800 clients and knowledge how VAT works in 100 locations.

Security

Data privacy and compliance

Your data stays safe with us. We use top security to protect your information, so you can focus on what matters.