The eCommerce package that came into force on July 1, 2021, introduced new tax provisions and related interpretation of rules when it comes to determining the place of supply for intra-community distance sales of goods.

The scope of the transactions that are part of the intra-EU distance sales of goods is extensive. The elementary parameters that should be primarily reviewed to eliminate at first glance the transactions that are outside the scope are the ones indicated below:

- Intra-EU supply of goods occurs when goods are dispatched or transported from one Member State to another;

- The supplier should be directly or indirectly part of the transportation or dispatch;

- Customers are natural persons or expressly indicated types of legal persons.

The orders of goods are typically made through the following channels:

- Mail order;

- Phone or tele-sales;

- E-commerce orders (different internet channels,e.g.,websites, web portals).

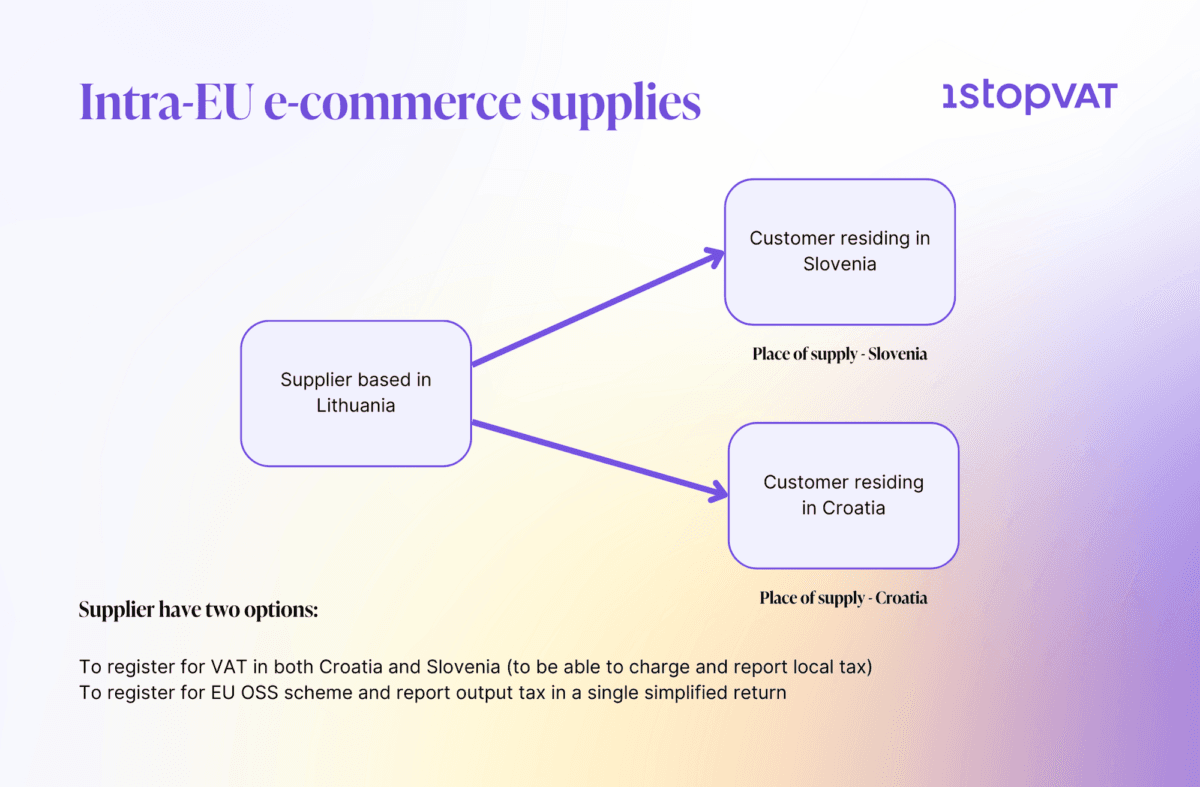

The e-commerce taxability rules for Intra-EU supplies of tangible goods physically transferred to the customer in a different Member State are defined according to the destination-based principle. Practically speaking, the place of supply is the Member State where the customer receives the goods.

The only exception to this general rule is the possibility for the EU-established supplier that hasn’t reached the intra-EU distance sales threshold to tax the transaction under local rules. The supplier that hasn’t reached the uniform EU-wide threshold could charge and report VAT according to the domestic regulations.

The introduction of the eCommerce package in 2021 has significantly reshaped the place of supply rules for online shopping. The taxability rules for intra-EU supplies of tangible goods transported or dispatched physically from one Member State to another have been updated. The destination-based principle has been the driving force for reporting since.

In summary, EU-based suppliers have two valid options: either register in each Member State to which they ship or deliver goods or adhere to the simplified EU reporting OSS scheme to reduce compliance costs.

Aleksandar Delic

1stopVAT Indirect Tax Manager – E-Commerce