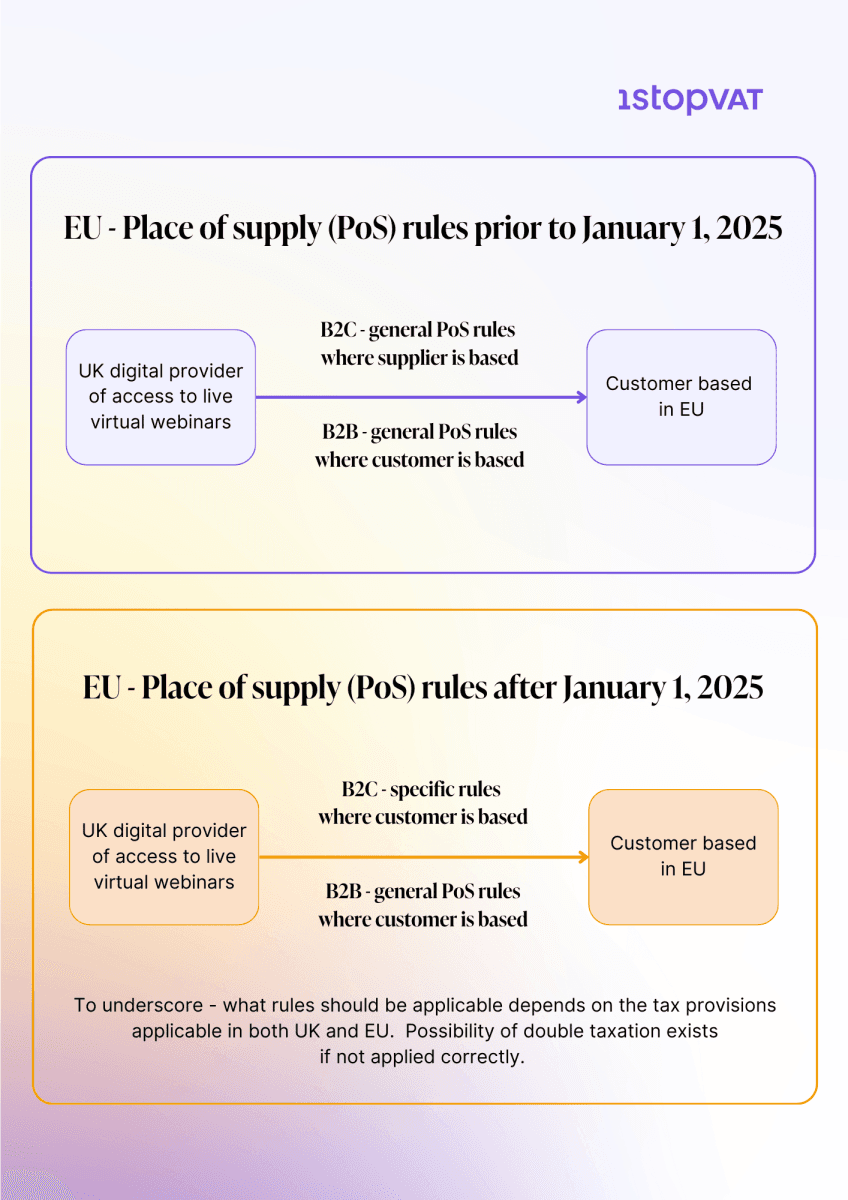

Starting from January 1, 2025, Council Directive (EU) 2022/542, adopted in April 2022, came into effect. This EC directive introduces significant changes concerning the place of supply rules for live virtual events. This change will substantially impact the providers of live virtual events whose place of business is within or outside the EU but have customers based or residing in the Common Market.

Providers of live virtual events, mainly streaming providers, who offer online services for accessing the virtual streaming of live events, such as attending online live conferences, seminars, webinars, training, and distance learning programs with live elements, should be aware of new VAT rules concerning the provision of these types of “digital services.”

Considering the rapid growth of this section of the e-commerce space, thousands of providers of online streaming services will be impacted by the new measures. The online streaming services platforms whose place of business is, e.g., the United Kingdom(UK), should be aware that if their customer is based in one or more of the Member States, they should follow the destination-based principle for reporting purposes.

This means that if the UK provider of online B2C streaming services of live conferences accepts and processes payments from customers based in Italy and Germany, the place of supply, according to the EU rules of the respective services, will be Italy and Germany. Additionally, this means that the UK provider should follow new rules for place of supply, defined following the EC Directive mentioned earlier.

However, the provider from the UK should be aware of whether the HMRC has implemented new rules adopted at the EU level to avoid any possibility of double taxation. The UK rules for this type of service provision follow the general place of supply for services concerning B2C transactions, while EU rules from January 1, 2025, follow the new destination-based principle.

Double taxation for the UK provider is possible if the UK still has the same rules.

We have previously discussed this subject. For a broader explanation, please refer to our previous article.

Digital service providers or online platforms that provide online streaming services of live virtual events (e.g., live webinars, live conferences, distance learning) should be aware of new reporting rules when their customers are based in the EU.

New place of supply rules trigger new types of registrations and reporting for these providers. To ensure VAT compliance with new provisions, the provider in question should be aware of the new taxation rules when it supplies these types of services to customers residing in one or more Member States.

Aleksandar Delic

1stopVAT Indirect Tax Manager – E-Commerce